Widespread concern over levels of late payments and bad debts

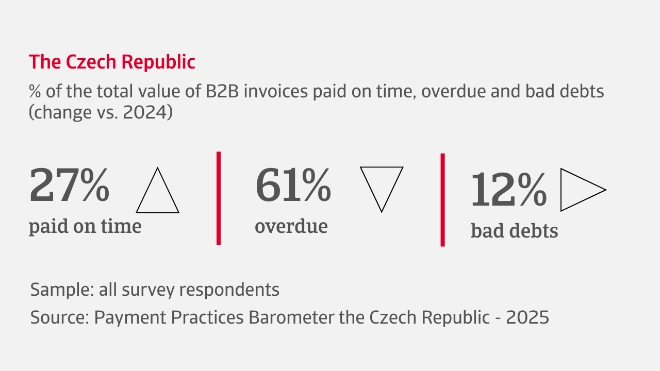

Companies in the Czech Republic are operating in a fragile payment risk environment, as the figures from our survey make clear. Late payments are a major concern, with 61% of invoices overdue in B2B and many firms telling us their customers are struggling with liquidity. Bad debts now account for around 10% of all B2B invoices, another hugely worrying signal. Although 40% of businesses say there is little change in customer payment behaviour, many others report a negative trend.

Days Sales Outstanding (DSO) has remained mostly stable, although more companies experienced slower payment collection than faster. Delays to incoming cash add to liquidity pressure, particularly as many firms are also dealing with stock build-up or slow-moving inventory, which limits their ability to unlock funds from existing working capital. The majority of firms say their Days Payable Outstanding (DPO) has increased, suggesting a deliberate effort to preserve liquidity by stretching out supplier payments, a tactic that can strain supply chain relationships.

Looking ahead

Uncertain mood sparks major switch to strategic payment risk management

Nearly 70% of businesses in the Czech Republic expect more B2B customers to default on invoice payments during the coming months. The rest are divided between those who expect no change and those who are unsure, reflecting how unpredictable the current economic situation is amid fast rising concerns about long-term financial health. The mood of uncertainty also extends to payment collection times, where companies are evenly divided between those anticipating no major changes and those who foresee a slowdown in payments.

The anticipated increase in B2B customer insolvencies will raise operational costs for Czech companies, heightening financial vulnerability. This makes it key for businesses to strengthen their credit management strategies to navigate the challenging economic environment

A range of external pressures are influencing this shift. Czech companies are worried about added pressure from tightening regulations, sustainability demands, and the need to stay flexible in a volatile global market. Geopolitical risks and supply chain challenges also continue to complicate operations, while trade disruptions and rising input costs are compounding financial pressures. In this challenging environment, the financial health of Czech companies appears vulnerable. While many are adapting, the widespread expectation of rising insolvencies and tighter liquidity highlights a difficult road ahead.

Industry insights

Chemicals

Just over 50% of B2B sales are transacted on credit in this sector, reflecting a cautious approach to extending trade credit and a steady trade credit policy in recent months. Most companies have kept payment terms unchanged, typically ranging between 31 and 90 days from invoicing. However, overdue payments continue to weigh on financial health, with 64% of B2B invoices reported as overdue, though this marks an improvement from last year. Bad debts remain a major concern, averaging around 10% of all B2B invoices, which places added strain on cash flow management.

Energy and fuel

64% of companies report no recent increase in trade credit offerings, with only about 40% of B2B sales transacted on credit. This highlights a risk-averse approach, prioritising upfront payments to safeguard cash flow in an uncertain economic environment. Most businesses have kept payment terms steady, typically within 31 to 60 days from invoicing. Despite this cautious stance, payment delays remain prevalent. Around 60% of B2B invoices are overdue, and three in five companies report bad debts averaging 10% or more of receivables. This is putting significant pressure on liquidity.

Steel and metals

Recent months have seen 70% of firms expand their trade credit offerings, with half of all B2B transactions now made on credit. This represents a shift toward more flexible trade credit practices, as many firms extend payment terms that span around one month from the invoice date. Overdue payments now affect just over 60% of B2B invoices, and bad debts average around 10%, highlighting significant pressure on cash flow. This is straining liquidity, especially as many companies report fluctuating DSO. On top of this, inventory build-up limits the ability of companies to free up cash from stock or receivables.

Interested in finding out more?

For a complete overview of the 2025 survey results for Czech Republic, download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- Czech Republic companies trading on credit with B2B customers are facing a challenging payment risk environment

- 40% of businesses across industries report little change in the payment behaviour of B2B customers in recent months, while others see a negative trend

- Maintaining liquidity is a key focus for the year ahead, while sales and profitability outlook remains subdued

- The expectation of rising insolvencies and tighter liquidity highlights a challenging road ahead for businesses in the Czech Republic