Every company that trades on credit with business-to-business (B2B) customers takes a calculated risk. The moment an invoice is issued, capital leaves the building, and a promise takes its place. In an ideal world, that promise is always kept. In reality, late payments and defaults can quietly erode profits, strain liquidity and stifle growth. Managing that exposure has therefore become one of the most strategic financial decisions a business can make.

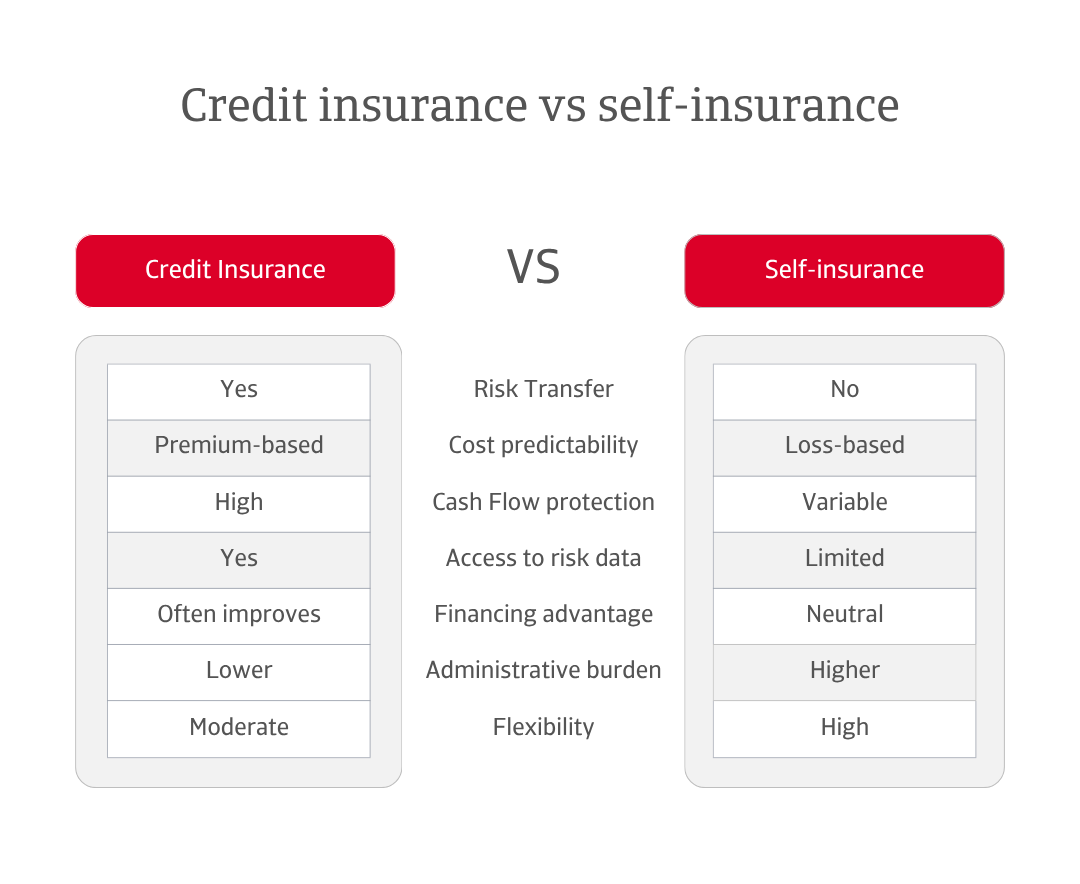

Should a company transfer the risk to an insurer, securing the certainty of payment even in the face of customer insolvency? Or should it manage the risk in-house, absorbing potential losses from its own reserves rather than transferring them to an insurer? Both approaches aim to protect cash flow, but only one provides the framework for the resilience and confidence businesses need to safeguard their financial health and drive growth.

In this article, we will explore how each approach works in practice, and why the distinction matter.

Cost trade-offs between the two approaches

At first glance, self-insurance seems financially efficient. Yet this apparent saving can unravel under the pressure of a single major default. Self-insurance demands that liquidity be kept on hand or that working capital be locked up to absorb potential losses. These idle funds could otherwise fuel investment, innovation or expansion. Credit insurance converts unpredictable bad-debt risk into a fixed, manageable cost. Premiums are typically modest relative to turnover and are often offset by better access to credit facilities. Banks and lenders, reassured by insured receivables, tend to offer improved borrowing terms or higher credit lines. The result is stronger liquidity, healthier balance sheets and the flexibility to pursue growth with confidence.

The difference between the two approaches becomes particularly stark when a customer defaults. An unpaid invoice forces the business to generate additional turnover simply to recover the loss. For example, with an unpaid invoice of €10,000 and a sales margin of 12.5%, a company would need to generate €80,000 in new sales—eight times the original invoice value—to offset the impact. With credit insurance covering 90% of the invoice, the recovery threshold drops to just €8,000. If part of the remaining loss is recovered through professional debt collection, the exposure shrinks even further. The difference is not merely numerical; it is strategic, reflecting fundamentally different approaches to risk and resilience.

Seen through the lens of opportunity cost, credit insurance rarely sits as a passive expense. It acts as a catalyst for capital efficiency, turning risk management from a defensive cost into an active driver of value. More than a safety net, it becomes an instrument of financial agility.

Key differences in credit risk management

Self-insurance offers businesses full autonomy over credit management decisions. For many, this independence supports agility and swift decision-making. Yet it also places full responsibility for monitoring and managing exposure to customer payment risk squarely within the business, a task that can become increasingly complex as portfolios expand or trading conditions shift, and one that often demands resources and expertise beyond day-to-day operations.

Credit insurance introduces a different kind of control, one built on data, analysis and structured oversight. Insurers continuously monitor customers’ financial health, issuing alerts when risks change and providing access to detailed intelligence on global markets. This partnership blends protection with insight, embedding a structured approach into the credit management process and reducing the administrative burden on internal teams.

In practice, this does not constrain decision-making; it sharpens it. Many firms find that insurer-backed intelligence strengthens their ability to take calculated risks, as they benefit from real-time insights drawn from a global network. The result is a balanced relationship between growth and protection, underpinned by data-driven decision-making.

Credit insurance frees capital for growth

Beyond protecting the balance sheet, the decision between credit insurance and self-insurance has a direct impact on a company’s growth trajectory. Businesses that self-insure must weigh each new opportunity against their financial capacity to absorb potential losses. As exposure rises, so does caution. This often limits how they can pursue new customers or markets, particularly those in unfamiliar sectors or geographies.

Credit insurance changes that equation. By underwriting receivables, it gives businesses the confidence to extend credit to new buyers, enter emerging markets and negotiate more competitive terms. The intelligence provided by credit insurance, often based on data from millions of companies worldwide, offers valuable visibility into counterparties and market trends. For exporters, it can mean trading safely in regions that might otherwise appear too risky. For domestic firms, it can mean outcompeting rivals by offering more flexible payment terms without increasing vulnerability.

This ability to act decisively gives insured companies a measurable competitive advantage. They can pursue opportunity faster, bid more confidently and recover more quickly from shocks. Trade credit insurance transforms risk from a constraint into a growth tool. For companies operating in industries where margins are tight and competition is intense, that agility can be decisive. The freedom to grow safely is no small advantage. In a volatile global economy, it can be the difference between steady progress and strategic stagnation.

Resilient growth starts with cash flow protection

The ability to grow with confidence is a rare advantage. Yet growth alone does not guarantee resilience. Enduring strength depends on structure, the kind that allows a business to face uncertainty without losing momentum. The decision between credit insurance and self-insurance goes well beyond cost. It is a question of structure, capability and confidence. How a company manages credit risk reveals not just its appetite for exposure but its broader approach toward growth.

Self-insurance can suit companies with substantial capital reserves, where taking on their own credit risk complements a preference for independence and control. Yet that autonomy comes with responsibility: a single misjudged customer or an unexpected insolvency can unsettle cash flow for months, sometimes longer.

Credit insurance, by contrast, provides more than protection: it underpins resilience. By combining data-driven oversight with structured risk management, it enables businesses to pursue growth confidently, knowing that exposure to customer defaults is monitored and mitigated. In this way, the focus shifts from merely managing risk to building a foundation capable of supporting both opportunity and stability.

Credit insurance vs. self-insurance: a choice that matters

For most companies, especially those with a large or diverse customer base, exposure to high-risk markets, or a strategic focus on optimising working capital and stabilising cash flow, credit insurance is clearly the more robust and forward-looking solution. It not only transfers risk but also provides access to expert intelligence, enhances financing options, and reduces volatility in receivables. While self-insurance may suit firms with exceptionally strong internal credit controls and minimal exposure to default risk, it demands significant discipline and offers no external support when things go wrong. In today’s complex trade environment, relying solely on internal buffers is increasingly a strategic vulnerability rather than a strength.

Deciding how to manage credit risk is never just a question of cost. It is a choice that shapes how a business grows, responds to uncertainty, and protects its future. Companies with this mindset see credit insurance not merely as a policy to buy, but as a strategic partnership—one that combines credit risk management, data insight, and long-term planning to support confident, sustainable growth.

This partnership-oriented approach underscores a broader truth: the choice between credit insurance and self-insurance is ultimately one of mindset. While self-insurance looks inward, relying on capital reserves and control, credit insurance looks outward, drawing strength from structure, intelligence, and collaboration.

For decision-makers evaluating their risk strategies, the question is no longer simply about cost or control. It is about ambition: how well protected is your company’s growth, and how prepared is it to seize opportunities when they arise?

To explore how to strengthen your own credit risk strategy, get in touch with us and see how we can help you stay ahead.

- Effective credit risk management protects cash flow and enables businesses to grow with confidence, especially in uncertain trading conditions

- To achieve this, companies must assess their needs and decide what fits best, recognising that strategic risk management involving insurance boosts resilience and unlocks financial agility

- With credit insurance, businesses shift the risk of customer defaults to Atradius, gaining structured protection, expert insight and the confidence to trade securely

- Alternatively, keeping credit risk management in-house saves on insurance costs and gives full control over decisions. However, it also means carrying the entire financial burden when customers fail to pay, which can strain cash flow and limit growth potential