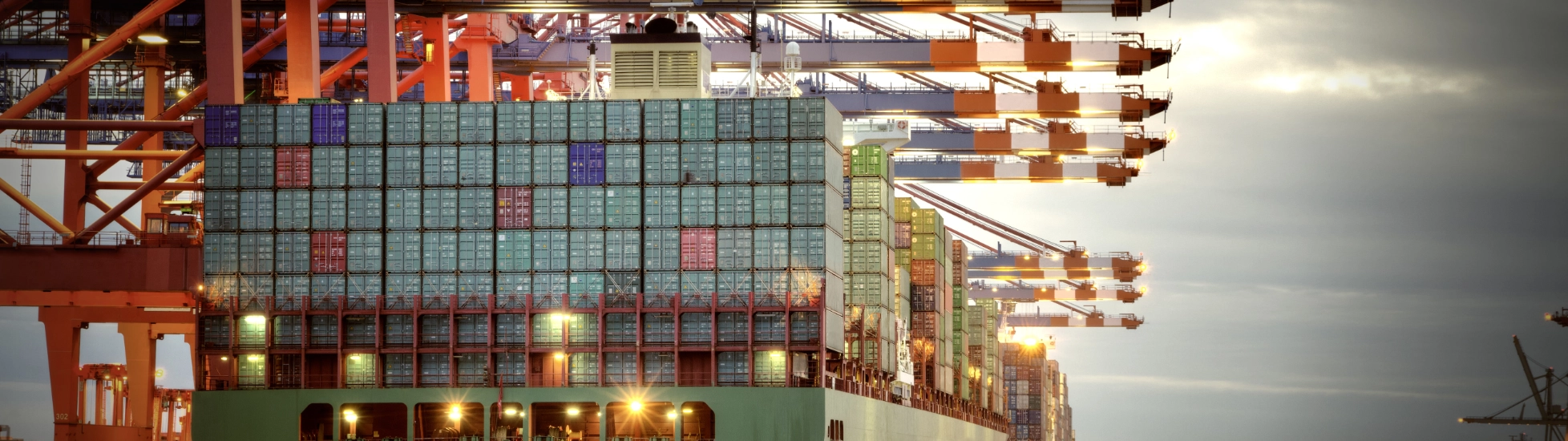

Trade and grow with confidence

Trade credit insurance from Atradius is a straightforward, cost effective and flexible way to ensure you get paid for goods and services you supply within the United Kingdom and abroad.

United Kingdom

United Kingdom

Trade credit insurance from Atradius is a straightforward, cost effective and flexible way to ensure you get paid for goods and services you supply within the United Kingdom and abroad.

Trade credit insurance from Atradius is a straightforward, cost effective and flexible way to ensure you get paid for goods and services you supply within the United Kingdom and abroad.

Our Trade Credit Insurance helps protect you from losses that may be caused by the failure of a customer to pay an invoice through insolvency, or their refusal or inability to pay under the terms of a contract.

Using Atradius Trade Credit Insurance can provide your business with:

"Atradius helped us to grow our business step by step. We have provided better services, been able to increase activity with old customers, and start business with new ones."

Easy account management

You can manage your policy directly through our online system - Atradius Atrium - to quickly establish credit lines, notify us of claims, track progress and implement changes.

Commercial debt collection is part of the policy

In addition to covering up to a maximum of 95% of bad debts, our debt collections...

One modula policy

Modula allows for varying levels of risk and need between customers to be clearly identified and differentiated. Providing a single policy promotes standardisation and clarity, while the individual modules allow for...

Monitor your portfolio with Atradius Insights

Atradius Insights is a sophisticated online analysis tool which can also be accessed via Atradius Atrium. Developed in close collaboration with our customers, it’s designed to help you easily...

Contact us