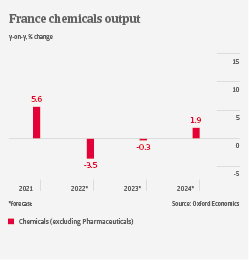

In 2021, French chemicals production grew by more than 5%. However, since Q2 of 2022 output and sales are facing decreasing demand from key buyer industries, and sharply increased input prices for commodities and energy. Additionally, high freight costs weigh on businesses´ financials.

All this puts high pressure on margins and cash flow of businesses. The paints and coating segment suffers from a combination of high energy prices and less demand from automotive, aeronautics and construction. In the agrochemical subsector the significant cost increase of energy and raw materials has resulted in sharply reduced production by some companies. That said, the basic chemicals subsector mainly consists of larger companies with good upstream/downstream integration and remains resilient in the current situation. Many producers active in the soap and detergent segment are able to pass on increased raw material prices to their customers.

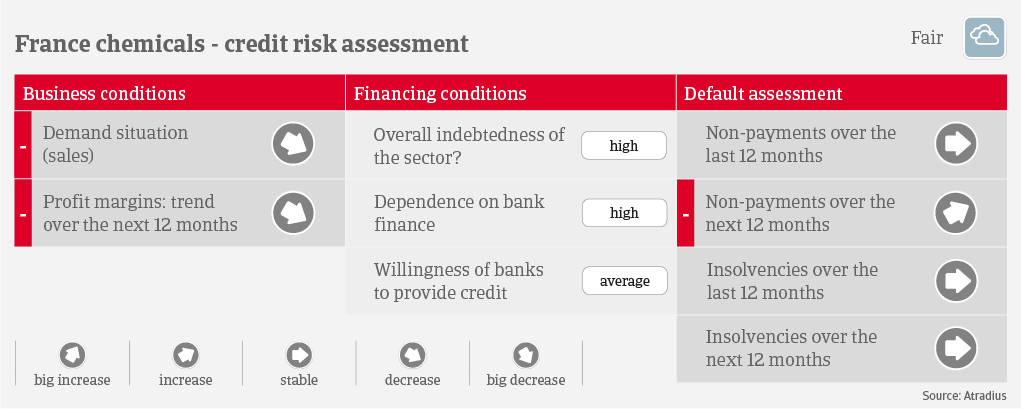

Payments in the industry take about 60 days on average domestically, while payment duration could be longer in export markets. Payment behavior has been good during the past two years, with a historically low number of payment delays. However, as very high energy costs negatively affect businesses´ margins and cash situation, we expect payment delays to increase in the coming 12 months by about 30%. That said, we expect only a slight increase in insolvencies of about 1%. Many companies in the chemicals sector are larger financially strong players, able cope with the difficult market environment. Therefore, we still assess the credit risk situation of the French chemicals sector as “Fair”. Additionally, the French government continues to support companies affected by high energy prices. Currently a proposal to double aid for energy-intensive businesses is under discussion. The government could also act as a guarantor for energy contracts.

However, state measures will also pose challenges in the coming years, as the French government plans to reduce emissions caused by the chemical industry - by 26% in 2030 compared to 2015. In order to reach this target a high level of capital expenditure is required. In particular, the plastics segment is facing the need for a speedy transformation due to environmental regulations, for example the EU ban on single-use plastics.