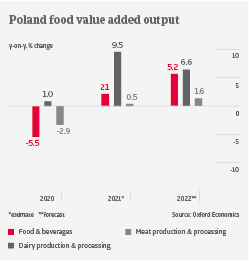

Food & beverages is one of Poland’s strongest industries, and value added output is forecast to grow by more than 5% in 2022. However, increased energy costs affect the margins of some segments (cold stores, food distributors, ready-to-eat meal producers), while meat producers and processors have to deal with higher prices for animal feed. Passing on higher input costs is difficult, as price competition in the retail segment is fierce. In this segment a concentration process is ongoing, and many smaller food retailers had to leave the market over the past couple of years.

Food & beverages is one of Poland’s strongest industries, and value added output is forecast to grow by more than 5% in 2022. However, increased energy costs affect the margins of some segments (cold stores, food distributors, ready-to-eat meal producers), while meat producers and processors have to deal with higher prices for animal feed. Passing on higher input costs is difficult, as price competition in the retail segment is fierce. In this segment a concentration process is ongoing, and many smaller food retailers had to leave the market over the past couple of years.

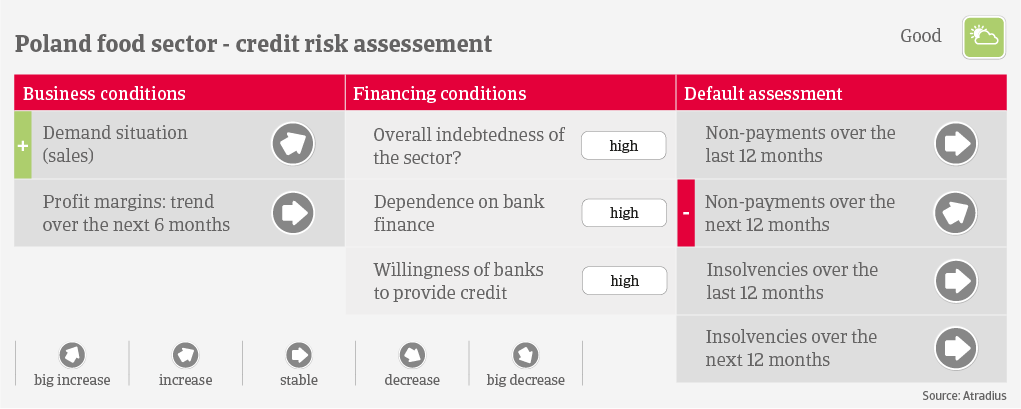

While we do not expect that profit margins of food & beverages businesses will deteriorate sharply in H1 of 2022, downside risks remain. Energy prices could become a serious issue if they remain high throughout 2022. Profit margins in the beverages segment could suffer from higher excise duties for alcoholic drinks. At the same time, rising interest rates could affect the profitability of companies with high bank loans. The gearing of many businesses is elevated, due to enforced investment in energy-efficiency and automation. Downside risks for the meat segment are an ongoing surge of bird flu and African swine fever, which could lead to import bans for Polish meat and a subsequent price deterioration. Any restrictions to stem the current spread of the coronavirus could hit again hospitality and related food services.

Payments in the industry take 30 days on average, and payment behaviour has been good over the past two years. Large extensions of payments are unusual, as businesses are afraid of any negative reputation as a “bad payer”. However, we expect a slight increase in payment delays of about 10% in the coming twelve months, as many businesses face higher input prices and lack options to pass them on. Insolvency numbers are low compared to other industries, and we do not expect a sharp increase in 2022. As the Polish food market remains dispersed, troubled businesses are often taken over by competitors instead of failing. The mid-term growth outlook for the Polish food sector remains good, and across all segments our underwriting stance remains open to neutral.