Local-owned Tier 2 suppliers remain susceptible to commodity price changes and exchange rate volatility, with limited options to pass on higher prices.

- According to OICA, Mexican vehicle production increased slightly (0.1%) to 4.1 million units in 2018, and 0.7% in H1 of 2019. Mexico has increased its share in the US market, partly compensating overall decreasing car sales in the US. However, domestic car sales decreased 6.4% year-on-year in H1 of 2019.

- In the short-term moderate production growth will continue as a result of foreign investment in the setup of auto parts and assembly factories. Stable sales of spare parts in the aftermarket segment are expected from a slight growth of the domestic vehicle fleet and a modest decrease in fuel prices.

- Manufacturers of car parts and assemblers are mainly subsidiaries of global groups, benefitting from robust foreign investment. Profit margins of OEMs and Tier 1 suppliers are expected to remain stable in the coming 12 months, while Tier 2 suppliers (mainly local-owned businesses) remain susceptible to commodity price changes and exchange rate volatility, with limited options to pass on higher prices to their customers.

- Payment terms in the Mexican automotive industry vary between 30 days and 90 days, while the average payment duration is 45 days. Payment behaviour has been stable over the past two years, and the number of protracted payments has been low. Most payment delays are in the auto parts dealers and retailers segment, which is exposed to price adjustments and exchange rate volatility. No substantial increase in payment delays or insolvencies is expected in the coming 12 months.

- Automotive businesses in Mexico are expected to gradually adjust to the USMCA agreement regulations. At the moment 70% of the industry in Mexico complies with the new rules of origin. According to USMCA, by 2023 40% to 45% of car parts must be made by workers who earn at least USD 16 per hour (average wages in the Mexican automotive sector are currently about USD 6 per hour). That means that in order to comply and to maintain competitiveness, Mexican businesses will likely accelerate the shift to production automation.

- Some OEMs already produce electric vehicles in Mexico, while others are preparing to start in 2020, without the production shift having a major impact on costs and profitability so far. However, the shift toward e-mobility could impact Tier 2 suppliers in the coming years, which would have to improve their level of specialization in order to meet the requirements of OEMs and Tier 1 players.

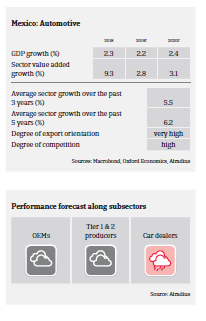

- Our underwriting position for the automotive sector is neutral for buyers involved in the vehicle production chain, but more cautious for buyers involved in the aftermarket segment and for car dealers, where businesses are affected by thin margins, strong competition and high levels of debt.

Related documents

Market Monitor Automotive 2019

1.19MB PDF