Insolvencies normalise, but trade war brings new risks

The promise and potential pitfalls of AI in international trade

Why now is the time to buy trade credit insurance

Ten tips to get your customers to pay on time

Case studies

Testimonials

Looking for safe havens in a divided region

Tariffs and related uncertainty causing a large negative impact

In some markets the indirect impact of tariffs could dampen higher food spending

Growing resilience tested by US policy shifts

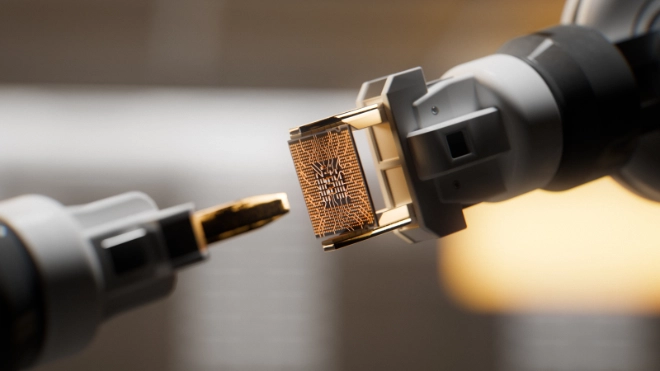

A temporary de-escalation in the US-China tariff dispute will support global electronics growth

The shock of US trade policy is unprecedented and is weighing on the global economic outlook.

Tariffs and related economic uncertainty weigh on commercial construction investment

Viewing 7 out of 163

The President promised the return of millions of factory jobs, but rising investment pledges masks a mixed picture for US manufacturing

100 years of managing risk, gaining knowledge and building trust

Closer ties could boost trade and create a functioning alternative to the misfiring WTO. But without the involvement of China and the US, can an EU-CPTPP partnership really have much impact?

While the deal brings a sigh of relief, unresolved details and ambitious targets leave businesses facing continued uncertainty and potential future trade tensions

Atradius Syndicate 1864 will focus on trade credit risks, initially targeting new and existing European clients in the financial industry sector.

Businesses face increasing supply chain risk as geopolitical tensions, tariffs and economic incentives create a new geography of trade, but forward-thinking organisations can benefit too

Amid economic and geopolitical volatility, ICISA highlights 2024 as a year that underscores the importance and resilience of trade credit and surety insurances.

Viewing 7 out of 50

Viewing 7 out of 29

Many businesses underestimate the true impact of buyer credit risk assessment. This oversight can quietly erode profitability

Resilience planning can be the difference between business growth and catastrophic failure

When people think of trade credit insurance, they often associate it with added security. However, it’s also a powerful tool for driving business growth and improving access to finance

In today’s trade climate, tariffs pose major challenges. This article explores how Incoterms help businesses clarify cost responsibilities, streamline logistics and reduce risks in international transactions.

A high Days Sales Outstanding (DSO) can strain cash flow, heighten risk, and hinder growth. Proactively managing DSO through credit policies, prompt invoicing, and effective collections is vital for financial resilience

Bad debts are not just an accounting issue, but a threat to your financial health

Viewing 7 out of 21

Every customer is a potential risk. The larger and more solvent they are, the greater the risk. In January 2023, Brazil witnessed a financial scandal that shook the market

Compare Credit Insurance and Atradius partner to Preventing £500,000 loss for electrical engineering contractor

Managing Director William Buchanan explains how Atradius helped Gressingham Group achieve mitigate risk and support their growth plans

Supporting existing and new customers growth and volume requirements while continuing to innovate in a fast paced, high growth market.

With the backing of Atradius’s resources, EnCom Polymers has been able to expand business with existing customers and go after new business they previously would have shied away from.

With the backing of Atradius’s resources, EnCom Polymers has been able to expand business with existing customers and go after new business they previously would have shied away from.

Viewing 7 out of 12

Omron has achieved sustainable growth while navigating the uncertainties of China-US trade relations and regional manufacturing transformation.

FERM (International) offers competitive payment terms and limits their credit risk to developing countries by using Atradius Dutch State Business (DSB) and the DGGF.

El Ganso credits our support in helping the fashion brand grow from a domestic-focused Spanish startup to a successful international business.

By providing open dialogue, insight and valuable credit information we helped Brook Green Supply improve their internal credit risk management systems.

Late payers prompted content marketing agency KMOdynamoo to take out an Atradius credit insurance policy and has resulted in better debtor management.

Janson Bridging (International) uses export credit insurance from Atradius Dutch State Business (DSB) to offer favourable credit terms to customers located in emerging markets.

Our agility and local knowledge of worldwide markets and buyers are key reasons why textiles business Georg Jensen Damask say they collaborate with us.

Viewing 7 out of 9